Investing abroad always sounds sexy—there’s something exciting about buying Brazilian stocks, betting on a rising Japan, or spotting an undervalued Kazakhstan champion. But after a year of feeling proud of yourself for finding that hidden gem, reality hits you: your "amazing" 20% return is only 5% once you convert back into your currency. Congratulations—you've just met your new, invisible partner in investing: the foreign exchange market. And trust me, it's far more unpredictable (and annoying) than you'd like.

Ironically, investors spend countless hours obsessing over company earnings, management quality, and industry trends—but currencies? Most of us treat them like background noise. Big mistake. The FX market is the silent co-investor who quietly takes a slice of your gains, sometimes leaving you only crumbs. And just when you think you understand the rules, currencies zig exactly when you expect them to zag.

Think about what's happening now in Europe. The continent is ramping up military spending, Germany’s sacred fiscal discipline rules are being tossed aside, and inflation risks are rising fast—everything textbook economics says should crush the Euro. So naturally, the Euro… strengthens?!

So let's dive in and figure out why currencies behave the way they do, why they sometimes do the exact opposite of what makes sense, and—most importantly—how understanding FX fluctuations can save your portfolio from unexpected headaches.

Welcome to Edelweiss Capital Research! If you are new here, join us to receive investment analyses, economic pills, and investing frameworks by subscribing below:

I. Why Should Investors Care About Currency Rates?

Let's face it: for most of us, foreign exchange rates are about as exciting as reading appliance manuals or listening to central bankers talk about "forward guidance." We prefer digging into balance sheets, hunting for undervalued stocks, or trying to guess the next Amazon—anything but obsessing over currency pairs with strange acronyms like EUR/USD or USD/JPY.

But here’s the catch: ignoring currencies is like carefully picking your dream house and then discovering it's built on quicksand. You might have nailed the perfect investment, but if the local currency starts sinking faster than the Titanic, your brilliant idea becomes worthless very quickly. Ironically, currencies don't care how much homework you've done on company fundamentals.

Let's say you bought shares in Toyota last year. The company crushed earnings expectations, and you're feeling like Warren Buffett's lost twin. But when you convert those beautiful yen back into your home currency—oops!—the yen has dropped 15% and wiped out half your gains.

And it's not just international investors who should care. Even if you only invest domestically, exchange rates still matter. Ask Apple, Nike, or basically any global exporter of your home country: a strong dollar can tank their profits faster than Elon Musk can send a tweet. Every earnings season, there's always a line from some CEO whining about "currency headwinds," conveniently blaming the invisible villain for disappointing investors.

II. 5 Major Factors Driving Currency Movements (The Usual Suspects)

Officially, currency prices come down to simple economics: supply and demand. Easy, right? Except that behind this apparent simplicity, there's an army of complicated factors—interest rates, inflation, trade balances, government debts, and, of course, politicians doing weird things.

1. Low Inflation and Trustworthy Central Banks

If there's one easy way to destroy a currency, it's inflation—lots of it. Just ask Argentina, Venezuela or Turkey. They could probably teach a master's course on currency disasters. On the other hand, countries with boringly low inflation, like Switzerland, or even Japan, have (normally) stable currencies because investors trust they won't wake up to find their savings turned into worthless paper.

Inflation is more or less linked to interest rates. Another whole book to discuss about it. Higher rates usually attract investors, strengthening the currency. If Europe offers a tasty 5% return and the U.S. gives you a sad 2%, guess where the money goes? Simple logic. But here's the irony: sometimes higher rates mean a country has runaway inflation. Just ask anyone who's bought Turkish lira lately.

2. Trade Balances

Then there’s the trade balance, which sounds boring until you realize it’s basically a country's report card. If China exports way more than it imports, it piles up foreign cash, making the yuan stronger. Meanwhile, the U.S. imports everything imaginable but still somehow maintains a strong dollar, thanks to investors worldwide parking their cash in American stocks, bonds, and real estate. Logic? Maybe not. But it works.

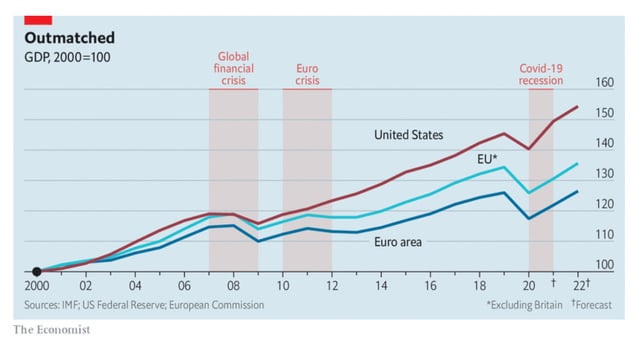

3. Economic Growth and Productivity

Countries with strong economies attract investment and demand for their currency. China enjoyed this for decades, as investors chased growth. The U.S. dollar also stays popular because, despite America’s endless deficits, investors still believe in Silicon Valley and Hollywood more than in, say, Europe's bureaucracy or Russia's diplomacy.

4. Responsible Government Spending and Debt

Responsible fiscal management is dull but reassuring. Norway's krone stays strong because they save their oil money instead of blowing it on populist policies. On the other hand, currencies from governments addicted to debt—hello again, Argentina—, or Lula’s Brazil in the last months, often weaken because investors worry about the printing presses overheating.

Government debt also matters. Too much debt, and investors panic about future inflation or defaults. Greece in 2012 showed us exactly how markets treat countries that spend like drunken sailors. Ironically, the U.S. has massive debts too, yet investors still trust the dollar because, let's be honest, where else can you safely put your money? (Bitcoin doesn't count yet.)

5. Political Stability and Reserve Currency Status

Investors value predictability—no sudden coups, no surprise nationalizations, no Twitter-happy leaders threatening tariffs at 2 a.m. Currencies from countries like Switzerland or Japan remain attractive precisely because they're predictable to the point of boredom.

Finally, some currencies have the unfair advantage of popularity—like the U.S. dollar. It's the world's reserve currency, which means everyone needs dollars for international trade. Even if the U.S. runs huge deficits and prints dollars like there's no tomorrow, investors still hold dollars because there's nowhere else quite as safe (at least for now).

III: When Currencies Misbehave

If predicting currency movements were as simple as reading an economics textbook, we'd all be relaxing on yachts instead of staring at Excel screens. Unfortunately, currency markets don't always follow logic—in fact, sometimes they seem to actively mock it. Let’s explore some classic “currency misbehaviors” and why they happen:

1. High Rates but Falling Currency: The Emerging Market Trap

Imagine a country offering juicy 20% interest rates. Great deal, right? But before you transfer your life savings, ask why rates are so high. Usually, eye-watering yields signal deeper problems—runaway inflation or shaky governments. Argentina, once again, is the master here: at times they've offered 70% yields, yet somehow investors still managed to lose money because the peso lost value even faster. Irony at its finest.

2. Buy the Rumor, Sell the News: FX Edition

Currency markets love pricing in events long before they actually happen. Suppose the European Central Bank hints at raising interest rates—traders immediately buy euros in anticipation. Then, when the ECB finally announces the hike, the euro might fall. Why? Because everyone who wanted euros already bought them.

3. Safe-Haven Surprises: Strengthening in a Crisis

In a crisis, currencies sometimes behave completely opposite of expectations. Remember the 2008 financial crisis? Logic would suggest the U.S. dollar—the epicenter of the mess—should collapse. Instead, investors panicked and desperately bought dollars, ironically making the dollar stronger. Or look at Japan’s yen, which tends to surge every time there's global turmoil—not because Japan is booming (it's not), but because people simply trust Japan's calm stability.

4. Policy Surprises: When Good News Turns Bad

Markets don’t just react to news—they interpret it. Sometimes central banks raise rates but warn about future economic weakness. Traders then ignore the higher rates, panic about the warnings, and the currency falls. Brexit provided a perfect example: when the UK actually voted to leave the EU, the pound plunged. Yet, later when Brexit finally happened, the pound rallied simply because the uncertainty was finally over. The market hates uncertainty even more than bad news.

Currencies misbehave because markets are run by humans—and humans love speculating, panicking, and generally making irrational decisions. Just remember: FX markets aren't guided by textbooks, but by millions of investors collectively losing their minds.

IV: Lessons from Druckenmiller

Today, Europe is throwing fiscal caution to the wind and splashing out €800 billion on defense spending. Germany—once the poster child for fiscal discipline—is suddenly borrowing money like a teenager with their first credit card. Yet, ironically, the Euro is rising instead.

Textbook economics screams that large budget deficits and low interest rates should destroy a currency. Druckenmiller’s practical insight? Not necessarily. According to him, in the short to medium term, massive deficits combined with relatively tight (or at least tighter-than-expected) monetary policy can make currencies surge. Why? Because growth expectations and capital inflows often outweigh theoretical fears of inflation—at least temporarily.

Ironically, this means investors, who had previously dismissed Europe as an economic basket case, are now pouring money back into European stocks and bonds. And as more euros get bought, its value rises—precisely opposite to what those pesky textbooks predict.

We’ve seen this script before.

a) Reaganomics & The Mighty Dollar (1980s):

Reagan spent big and ran huge deficits. The Fed, however, kept interest rates extremely high to fight inflation. Result? A soaring dollar—up nearly 80% from 1980–85. Economists were baffled; Druckenmiller just smiled.

b) Breaking the Bank of England (1992):

When Germany reunified, it splurged on East Germany, running massive deficits. The Bundesbank hiked interest rates to fight inflation. Druckenmiller saw it clearly: strong German fiscal spending + high rates = strong Deutsche Mark. He bet on DM strength vs. a weaker British pound. Result: Soros and Druckenmiller made billions, famously "breaking" the Bank of England on Black Wednesday as the pound collapsed.

c) Euro’s Pandemic Paradox (2020):

During COVID, the EU printed euros and spent lavishly—but less than the U.S. printed dollars. Druckenmiller’s relative approach worked again: despite deficits, Europe looked fiscally tighter compared to America’s even bigger deficits. Result? Euro surged 10% against USD. Irony again, courtesy of the FX market.

d) Dollar Strength Again (2022):

America ran big deficits (COVID stimulus), but the Fed sharply raised interest rates to control inflation. Druckenmiller again was proved right: investors chased high yields in the U.S., boosting the dollar to 20-year highs. Conventional theory would panic over U.S. deficits; reality rewarded investors who understood the Druckenmiller playbook.

Yet Druckenmiller himself warns there’s no such thing as a free lunch. If Europe’s spending binge leads to runaway inflation, or if the ECB gets cold feet and doesn't tighten enough, the euro could quickly go from hero to zero.

Bottom line: Europe’s euro is strong right now precisely because the market believes it. But that belief depends on trust—a currency’s greatest asset and most fragile luxury. As always, Druckenmiller reminds us that the market doesn't care about textbooks; it cares about what investors believe might happen next. And right now, they believe Europe's fiscal madness might actually be good—at least for today.

Textbooks aren’t stupid—they just underestimate market psychology. Druckenmiller realized early that currency traders care less about the deficit itself, and more about what central banks and politicians do next. If markets believe a big-spending government will generate real growth and central banks won’t let inflation run wild, they pile into that currency. Ironically, sometimes being fiscally reckless in the short run (with a credible central bank) makes you very attractive to global capital.

V: Short-Term Chaos vs. Long-Term Sanity

If you've ever believed you were Druckenmiller predicting short-term currency moves, you'll know it's impossible and frustratingly random. One minute currencies behave quietly, politely moving a tenth of a percent here or there. The next, they're bouncing around like a toddler after three espressos.

Here's the thing: short-term currency movements often have nothing to do with economic reality. Instead, they're driven by headlines, rumors, or some algorithm’s nervous breakdown. Europe announces slightly worse-than-expected inflation? Boom, the Euro drops 2% instantly. Did Europe's economy really shrink that afternoon? Nope. Traders just had a collective mini-panic, fueled by too much caffeine and too little perspective.

Ironically, the shorter your investment horizon, the crazier the currency market appears. Trying to trade FX in the short run can feel like financial roulette—fun when you win, depressing (and expensive) when you don't.

But there’s good news: sanity usually returns over the long haul. Fundamentals—things like inflation rates, productivity, debt levels, and trade balances—matter over time. Take Switzerland, for example: decades of low inflation have made the Swiss franc steadily stronger. Meanwhile, Brazil’s real has generally gone downhill over the same decades because, well, Brazil struggles with stability like I struggle to resist carbs.

If you’re investing internationally, be patient. Ignore daily currency headlines unless you enjoy stress-testing your heart. In the long run, currencies find their way back to reality—eventually. Just be prepared: "eventually" might mean weeks, months, or even years after you've thrown your laptop out the window.

VI: Risks of Investing in Countries with Unstable Currencies

Investing in emerging markets can feel like dating someone exciting but unstable—lots of potential, plenty of drama. They promise great returns, but the currency always finds a way to ruin the party.

1. Erosion of Returns

Imagine you found the next big thing in Brazil. You did your homework, invested carefully, and voilà—your stocks soared 20%. Great, right? Then you check your returns in euros and realize you actually lost money. Wait, what? Turns out the Brazilian real dropped 25% during your little adventure, and your profits vanished faster than politicians' promises after election day.

Sadly, this is more common than you think. Argentine pesos, Turkish lira, Brazilian reais—they often look attractively cheap, but remember: they're cheap for a reason.

2. Volatility and Unpredictability

Currencies in unstable countries don’t just gently decline—they crash spectacularly. One day you're calmly sipping coffee; the next day some government official wakes up feeling adventurous, announces something absurd, and your currency collapses 10% in a single afternoon.

3. Capital Controls

When things get really bad, desperate governments might lock the exits—also known as "capital controls." Imagine investing in Argentina, deciding you've had enough, and then discovering you can't actually take your money out. Even without controls, thin currency markets mean you might not get the exchange rate you expected—so your money takes a forced "discount vacation."

4. Deeper Economic Problems

Currencies don’t collapse randomly—they're usually warning signs of deeper issues like government corruption, fiscal irresponsibility, or runaway inflation. If the currency is falling apart, chances are good the economy underneath isn’t thriving either. Remember the Asian Financial Crisis? The Thai baht and Indonesian rupiah collapsed, and investors didn't just lose on currency; companies loaded with foreign debt also went bust. Double trouble.

5. Opportunity Cost (Is This Headache Worth It?)

Before diving into markets with wild currencies, ask yourself: "Is this investment really worth losing sleep over?" Sure, Brazilian or Turkish stocks might look tempting, but if their currencies depreciate faster than your returns grow, why bother? Sometimes the less glamorous, stable markets deliver better long-term results—without the drama.

And let’s not forget the cost of capital trap. You might expect a company to deliver 15% intrinsic value creation, but if interest rates in the country are also 15% (or higher), what do you really expect? Investors demand high returns in risky markets for a reason. That's why return on equity or in invested capital expectations in emerging markets are way higher than in developed ones—otherwise, why take the risk? A business earning 15% in a country where the cost of capital is also 15% isn’t actually creating value—it’s just running in place.

Emerging markets aren't off-limits, of course. Sometimes, when everything aligns perfectly, they can deliver amazing returns. But currency risks are real, serious, and definitely not to be ignored. High volatility, currency erosion, and deeper economic instability mean you should never put too many eggs in these shaky baskets.

Currency markets are weird creatures. Part rational economics, part investor psychology, and part complete chaos. Ignoring currency risk as an investor is a bit like trying to ignore gravity—it doesn't end well. Even the best investment can end up as a total flop if the currency gods decide to punish you.

You’ll never fully predict currency movements, so don’t even try. Instead, focus on fundamentals, learn to endure the short-term noise, and keep your eyes on the long-term horizon. Do that, and you'll survive—and maybe even enjoy—the wild rollercoaster of investing abroad.

And when currencies inevitably surprise you (again), just remember: at least investing will never be boring.

If you enjoyed this piece, please give it a like and share!

Thanks for reading Edelweiss Capital Research! Subscribe for free to receive new posts and support our work.

If you want to stay in touch with more frequent economic/investing-related content, give us a follow on Twitter @Edelweiss_Cap. We are happy to receive suggestions on how we can improve our work.

Great research piece, kudos, thank you!

A very important context in the current investment environment. China is now implementing inflationary policies, with low bond returns due to the government’s continuous bond purchases, which can be very problematic for European investors.

In commodities sector the cyclical enviroment is important, but here too .

I´m studying diverse chinese companies and this point is very importtant