#36 Management & Incentive Schemes III: the Good

Companies with compensation schemes to sleep soundly

We have invested the last 2 weeks looking at incentive systems that were not necessarily aligned with shareholders’ interests. But the time has finally come. Today we are looking at 3 companies, each one better than the previous one. We will learn how to identify management teams whose priorities, and salaries, are focused on creating long-term shareholder value.

Welcome to Edelweiss Capital Research! If you are new here, join us to receive investment analyses, economic pills, and investing frameworks by subscribing below:

How does a company create new value? The answer we will receive from the average manager will be a string of more or less empty statements. The reality is that a company generates new value for its shareholders by reinvesting its capital at higher rates of return than the cost of capital. Full stop. Everything else is garbage.

In the compounding value series (Part I, Part II, and Part III), we went deep into it and saw the theoretical framework, which we later applied to LVMH and to compare Costco and Walmart.

If this is the only way to generate value, management incentives must be imperatively linked to it. A metric on capital returns and another one on growth. ROIC and revenue growth. ROE and book value per share in a financial institution. It is not that difficult. Any other is just an attempt to mask the key points.

Having said that, it is not necessary, nor advisable, that every employee in a company should have the same incentives, just as they do not have the same tasks and responsibilities.

The CEO is the leader on whom everything depends. It is the CEO who has to worry about achieving growth at high returns on capital. It is the CEO who has to design a cascade of incentives for his subordinates to harmonize their own objectives.

That is why it is so important for the CEO of a company to understand the wonderful mechanism of value generation. And believe us when we say that unfortunately, it is not that common. In addition, it is almost essential that the management team really have important stakes in the company. If the enrichment of a management team is linked more to share price appreciation than to their salaries, bonuses or huge amounts of stock options, we have come a long way in aligning their interests with those of the shareholders.

We are presenting today 3 relatively well-known companies: Waste Connections, W.R. Berkley Corporation, and Constellation Software. While the first two are examples of incentive schemes that are well above the market average and have resulted in more than decent returns over the past decades, Constellation stands out as the single best incentive scheme we have ever seen.

Waste connections

Waste Connections is a waste services company that provides non-hazardous waste collection, transfer, and disposal services. Based in Canada, the company was founded in 1997 and operates in Canada and the US. Since the IPO in 2016, the company has compounded at rates over 15%.

Looking at insider ownership, we can see none of the management members have a relevant stake in the company. Exec. Chairman and the CEO have stakes worth 30 and 18m respectively.

We like to compare normally the insiders’ ownership with other two parameters: the total compensation and the FCF (and not the revenue as many managers like to do).

In the case of Waste Connections, we can say the managers have a relevant part of their wealth and compensation tied to the shareholders. It is not an absolute percentage, but rather a meaningful quantity.

Compared with the FCF in 2022 of around $1000m, 7m for the total CEO compensation seems reasonable.

Let’s move on with the incentive schemes. It is our view that Waste Connections is one of the seldom companies which achieves our approval in terms of a good incentives program. Why? The scheme is relatively simple. It has most of the compensation at risk and is dependent on the company's performance. Furthermore, the metrics are transparent and clear.

A base salary of $900k for the CEO, joined with an annual short-term cash incentive based on the metrics below (not perfect but good enough):

It is always important in these cases to evaluate whether the targets set by the remuneration committee are demanding enough. We conclude with what we really like: long-term incentivization based on return on capital constant improvement and FCF/share growth. Both inherent elements of real long-term value creation:

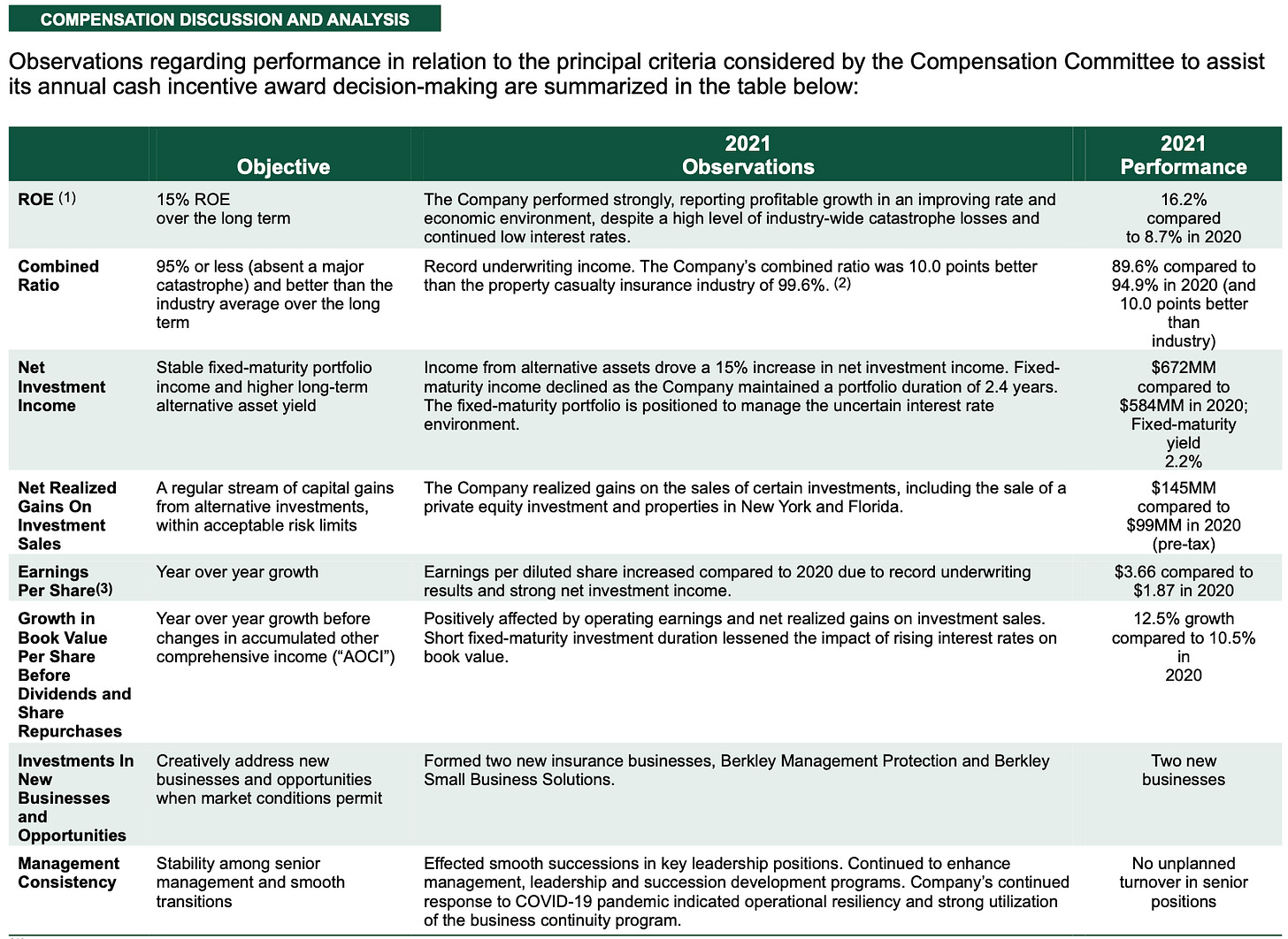

W. R. Berkley Corporation

W.R. Berkley Corporation is an insurance company founded in 1967 in Connecticut. The company was a 10-bagger after the first 12 years in the public markets (IPO in 1985). It reached the status of 100-bagger in 2019 after 34 years, and thanks to the beauty of compounding, it just reached the new milestone of 200-bagger this year.

Mr. W.R. Berkley, founder and Exec. Chairman, keeps owning 20% of the company (now worth $3,6b). His son, and current CEO, owns $126m. Again, even if they are the owners, compensation is clear and simple: 1m base salary. Annual cash bonus based solely on ROE. Short-term RSUs are based also on ROE and mandatorily deferred until separation from service. Long-term incentive equity awards are based on the growth of book value per share over 5 years. All in all, father and son compensation amounted to $14m out of the 2,4b of FCF.

The proxy statement is a piece of information worth reading:

We make long-term decisions to enhance long-term ROE and build stockholder value. Our long-term goal of 15% ROE has remained consistent for our entire 50-year-plus history. Although 15% is a demanding hurdle for a property casualty insurance company in a historically low-interest rate environment, the Compensation Committee believes it remains appropriate as a long-term goal in order to challenge management to maximize stockholder value.

The cherry on the cake: Constellation Software

As always, we have saved the best for last. We regret always having to go back to these guys, but they are simply the best when it comes to incentives.

For those who don’t know them yet, Constellation Software acquires and manages vertical market software businesses around the globe. Its industry-specific software businesses provide specialized and mission-critical software solutions. Founded in 1995 by Mark Leonard and headquartered in Toronto, it made its IPO in 2006 and achieved its status of 100-bagger in just 15 years.

We might fall into several biases here, but we are quite sure that this spectacular performance is rooted in a corporate culture and incentive system simply superior to anything we have seen to date. It's not just that Constellation meets all the requirements we've stated above in terms of management ownership and compensation vs FCF ratio. It is that they are simply in another league.

Everything that has passed through Mark Leonard's hands is worth reading. As such, we reproduce how Constellation approaches incentives and compensation:

The Corporation’s executive compensation program consists of base salary and annual incentive compensation. The annual incentive compensation is paid by way of a cash bonus, although a portion of the bonus is usually required to be used to purchase Common Shares. Certain CSI executives voluntarily waived portions of their salary and bonus entitlements in 2021 and in previous years.

The highest base salary of all Constellation Software employees is $450k.

Annual Incentive Bonus

The objective of our annual incentive bonus is to reward employees for working towards our goal of increasing shareholder value. We believe that shareholder value is created by managing two financial components over the long term: profitability and growth. As such, our corporate bonus plan, which compensates employees at all levels of our organization, is based upon return on invested capital (“ROIC”) and net revenue growth (ROIC is calculated by dividing net income for bonus purposes for the year by the Average Invested Equity Capital for the period.). “Average Invested Equity Capital” represents the average equity capital of CSI, and is based on the Corporation’s estimate of the amount of money that our common shareholders have invested in CSI.

The company performance factor is determined by reference to net revenue growth and ROIC. ROIC is calculated by dividing net income for bonus purposes for the year by the Average Invested Equity Capital for the period. A ‘risk free’ rate of return established by the board (currently 5%) is netted from the ROIC. If the ROIC does not exceed the risk-free rate of return, then the manager of the business receives no bonus. The Corporation measures growth by looking at the year-over-year increase in net revenues for the particular Operating Group.

In considering the implications of the risks associated with the Corporation’s annual incentive bonus structure, the CNHR Committee was satisfied that the counterbalance between ROIC (calculated by dividing net income for bonus purposes for the year by the Average Invested Equity Capital for the period) and net revenue growth and the requirement to invest 75% of their after-tax incentive bonus into Common Shares mitigates the risk that a Named Executive Officer would take inappropriate or excessive risks in respect of the Corporation’s operations.

Investment of Annual Incentive Bonus in Constellation shares

Executive officers are required to invest 75% of their after-tax incentive bonus into Common Shares. (And they do it in the open market, just like any other shareholder). The shares are held in escrow for a minimum average period of four years. Once in every five-year period, executive officers may choose to receive their bonus entirely in cash.

Mark Leonard’s Compensation

Mr. Leonard’s compensation for acting as President of the Corporation during fiscal 2021 was determined by the CNHR Committee. Mr. Leonard’s and head office employees’ incentive bonus entitlement is calculated in the same manner as the other executive officers as described above. In 2019, 2020 and 2021, Mr. Leonard voluntarily waived his entitlement to receive a salary and a bonus.

There would be infinite points to make and details to discuss that have made Constellation what it has become. We could summarize them in two points: simplicity in everything and continuous craziness about value creation. Both of these are faithfully reflected in Constellation's compensation system.

Perhaps we fall back on survival bias, but we have never come across an excellent incentive system where the underlying company has not performed excellently.

It is obvious to everyone that an extraordinary incentive system will not ensure success, but it is definitely a great place where to start. We are quite sure the more incentive schemes similar to Constellation's we find, the more we get close to succeeding. And never forget: if you find one of these rare unicorns, share it with us!

If you enjoyed this piece, please give it a like and share!

Thanks for reading Edelweiss Capital Research! Subscribe for free to receive new posts and support our work.

If you want to stay in touch with more frequent economic/investing-related content, give us a follow on Twitter @Edelweiss_Cap. We are happy to receive suggestions on how we can improve our work.

Excellent article

Great post. Find it really useful to see what a good compensation structure is, as it is really hard to find them in most companies. I like to invest in owner operated companies as it makes things easier.

Regards,

Dani